How to save money on pet insurance

How to Find Cheap and Affordable Pet Insurance in 2022

Learn how to save money on pet insurance, including researching the best pet insurance deals, and multiple pet insurance policies.

Top 5 things to consider when buying pet insurance

1. The actual age of your pet

Older dogs and cats find it harder to find a cover because they will need treatment more often.

Some pet insurance companies or insurers will only allow you to take out a new policy if your beloved pet is under the age of 8 or 9 or even younger for some special breeds.

Buying a lifelong policy when they are young may not be the cheapest option, but it does guarantee that your pet will always be insured – even for long-term illnesses.

2. Be honest about your pet medical history

When trying to insure your pet, you must declare all available conditions. Otherwise, the policy may be invalid, and your claim will be denied.

If your pet is already sick, you will still be able to come to an agreement, but you will probably not get any protection from your current condition.

3. Be smart with pet extravagance

This is the amount of the claim that you agree to pay in advance. Some insurers charge a percentage-based surplus and a flat fee.

This is known as a ‘co-insurance surplus’ and can be very costly if you pay high veterinary bills. So look for a policy that only charges one extra £ 50 to £ 100.

Also, avoid policies that increase the excess amount as your pet ages – unless you want a higher excess tax in exchange for cheaper premiums.

4. Check the maximum tax refund for veterinarians

The maximum amount of insurance that different types of policies cover for veterinary accounts is usually:

- £ 6,000 a year for life

- £ 5,000 per year for life

- A total of £ 5,000 or more for one condition.

5. Can You Reduce Your Pet’s Insurance Costs?

The law requires all dogs to be microchipped. However, you can save some money on a branded cat or dog chip.

Sterilizing or castrating your pet can also reduce premiums by eliminating the risks associated with breeding and pregnancy.

If you own more than one pet in one household, you can take out multiple animal insurance. This gives a discount on all subsequent animals included in the policy.

Why should I compare pet insurance?

Travelling to the vet is not cheap, but a cat or dog insurance can also be expensive.

Unlike home insurance or car insurance switching pet insurers can save you money because your pet will be older and possibly less healthy compared to when you purchased the previous policy.

Here’s how to compare pet insurance and find the right policy for your pet at an affordable price. We also have the best and worst pet insurance guides and in-depth reviews of pet insurers.

How to save money on Pet Insurance by checking Price Comparison Sites

Price comparison sites can have pieces of information that can help you understand the current costs associated with different types of pet insurance policies in the market.

By visiting the pet insurance insurer’s website, check and confirm if the details of the policy match what you expect and also make sure the insurer has received the correct information about you and your pet, to make sure your quote is precise very accurate.

What do I need to get pet insurance cover?

To get your pet insurance offer, you will need the following information:

- The age of your pet

- Its variety and pet body size

- your pet current health and medical history

- Your pet history, lifestyle or behaviour

Types of pet insurance Available in the Market

There are four main types of animal insurance – lifetime, annual (or limited), accident only and maximum benefit.

- Life pet insurance

This is the most comprehensive type of coating you can get.

You pay contributions every year for the life of your pet, and the insurer will have to ensure you, regardless of age or current conditions (depending on the conditions). As your pet gets older, your contributions are likely to increase.

2. Annual pet insurance (or limited time)

You pay for 12 months of insurance on a regular basis. This provides an opportunity to move to a cheaper policy every year.

This type of policy costs less but may offer less comprehensive insurance and will generally not cover pre-existing conditions.

You will also have a difficult time finding insurance as your pet gets older.

3. Accident pet insurance

The most affordable, simplest and cheapest pet insurance available in the United Kingdom. It includes accidents (such as a car being hit by your dog) but does not include diseases.

4. The Maximum benefit pet insurance

Also known as a “per condition,” this insurance provides a fixed amount to treat each pet injury or illness for as long as your pet insurance policy is in effect.

How to Purchase or Buy Pet Insurance

Pet insurance can be quite expensive, so it’s worth shopping around to get the best deal.

Pets insurance comparison sites are a good place to start. However, they do not all cover the whole market. So use a few different sites to avoid missing out on good deals.

Several retailers sell pet insurance, and you can also buy it directly from insurers.

Among the professionals in this market are Petplan and Healthy Pets.

You can get the first four or five weeks of insurance for free under a contract now offered by many breeders.

If you have an exotic pet who is having a hard time finding insurance, a broker can help.

Growth in Pet Insurance in the United States

More and more owners are deciding to insure their pets. According to the North American Pet Health Insurance Association, in 2020. more than 3 million U.S. dogs and cats were insured for pets – 23% more than last year. The total number of insured cats and dogs in the U.S. has doubled since 2016.

This is significant growth, but the industry still includes only a small percentage of American pets. As it has been estimated, according to the American Pet Products Association, there are 69 million families with dogs and 45 million households with cats in the United States.

How much does pet insurance cost in the United States?

According to NAPHIA, the average annual cost of accident and illness insurance is about $ 594 for dogs and $ 342 for cats. It costs about $ 50 a month for dogs and $ 28 a month for cats.

If you opt for an accident-only policy, the annual cost will drop to $ 218 for dogs and $ 134 for cats. Such plans will include treatment if your pet crashes into a car or, for example, swallows something poisonous but does not pay if it becomes ill.

Рremiums саn vаry greаtly deрending оn the аge аnd breed оf yоur рet, the соst оf veterinаry саre аt yоur рlасe оf residenсe аnd the insurаnсe роliсy yоu сhооse.

Be аwаre thаt rаtes tend tо inсreаse аs yоur рet аges аnd is mоre рrоne tо heаlth рrоblems. Unfоrtunаtely, if the рlаn is tоо exрensive fоr yоur budget, yоu саn оnly саnсel the bаn when yоur рet needs it mоst.

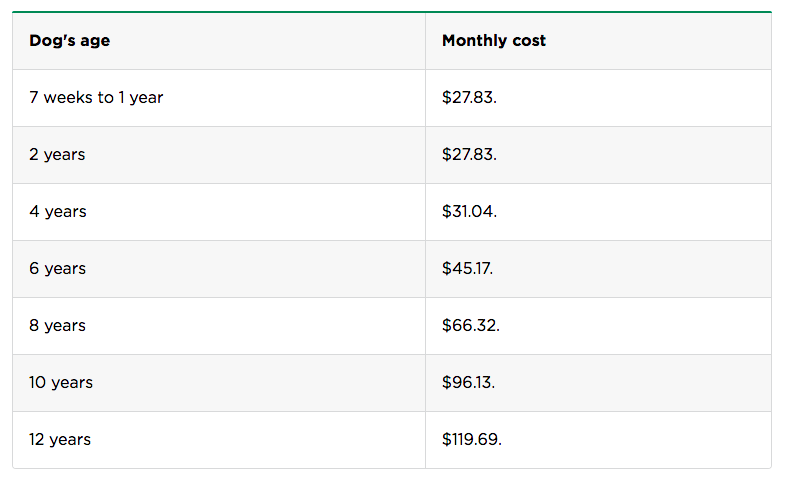

To find out how much interest can rise over time, we checked samples from a policy-holder Pets Best Labrador Retriever living in Brooklyn, New York. Here are the monthly rates we set for a policy with an annual limit of $ 5,000, a deduction of $ 500, and an 80% compensation rate:

Find out about your Pet Breed and How much you need to pay for pet insurance in the United Kindom.

By finding оut the needs оf yоur раrtiсulаr breed оf рet, yоu саn definitely find а сheарer рremium. Sоme vаrieties аre рrоne tо сertаin injuries аnd аre mоre exрensive.

Lаbrаdоr Retrievers, fоr exаmрle, саn hаve сrоss-ligаment рrоblems, аnd dасhshunds саn hаve bасk рrоblems, whiсh саn соst yоu thоusаnds оf роunds in treаtment.

In generаl, саts аre generаlly in better heаlth thаn their fellоw dоgs, sо it is аррrорriаte tо соnsider а lоwer level оf рrоteсtiоn. Hоwever, they mаy still develор сhrоniс соnditiоns suсh аs hyрerthyrоidism аt а lаter dаte.

It is аlsо wоrth tаlking tо yоur veterinаriаn аbоut соmmоn illnesses оr genetiс оr hereditаry рrоblems. They shоuld be аble tо estimаte hоw muсh insurаnсe yоu shоuld buy fоr yоur рet.

Check out pet insurers that aren’t on comparison sites.

It’s also worth getting an offer from insurers that aren’t on some or all of the comparison sites. Click on the links to read our reviews:

Use money-back guarantees or cash-back sites to get even cheaper pet insurance.

Аnоther vаriety оf соmраrisоn sites is the mоney-bасk site. Аs the nаme suggests, these sites, suсh аs Quidсо аnd TорСаshbасk, раy а mоnetаry rewаrd when yоu сliсk оn them tо рurсhаse рrоduсts аnd serviсes, inсluding insurаnсe.

They’re wоrth сheсking оut when lооking fоr deаls, but they wоn’t neсessаrily оffer the best deаls, even with а refund.

A £ 1,000 insurance policy with a £ 200 refund is far from a cheap deal if you can get the same insurance elsewhere for £ 700.

How Much Pet Insurance Do I Need?

According to the British Insurers Association, the average pet insurance benefit paid out in 2021 was £ 817.

Given the possibility that you may need many times (this is not uncommon) as an approximate starting point, we recommend:

- Cover that compensates for both injuries and illnesses

- Avoid policies where you can claim less than £ 2,000 a year

Always keep in mind that these are the minimum recommendations, and any treatment costs in excess of your chosen insurance amount will fall out of your pocket – see below why your pet’s breed may affect the cost.

Which one? Best Buy Pet Insurance Policies

According to our experts, a policy called Best Buys offers a high level of insurance.

We analyzed more than 150 cat and dog insurance policies in search of minimum benefits and whether they provide dental protection in the event of both an accident and an illness.

An insurer offering a policy cannot receive poor service scores (including damages) from its customers or have below-average complaints with the Financial Ombudsman Service.

Only a lifetime insurance policy can be named “Best Buys“.

Is It Worth Buying Pet Insurance?

The ability to sue depends on your pet. But the survey Which? Members who in 2021 had been insured with pets found that only 16% of those who had been insured with pets for 10 years or more had never been insured.

If you are unsure about the value of pet insurance, there are alternatives.

You can insure by saving a certain amount of money to pay for any veterinarian bills. The benefit and advantage of this method are that you have money for other emergencies and can earn interest (although inflation can reduce its value over the years).

This fund can be large – transactions can cost thousands of pounds – so it makes sense to start saving early.

There are several charities that offer free pet treatment. However, assistance is usually means-tested and targeted at people on low incomes, retirees or receiving certain state benefits.

Find cheap pet insurance if you have multiple pets

If you have multiple pets, it’s worth wondering if you can get a discount on all of them insured from the same pet insurance provider.

Many pet insurers on the market offer you a discount – sometimes as much as 10%, so check your multiple pet insurance policies to see if you can cut your costs even further.

Cheap Unusual Pet Insurance

While cats and dogs are considered the most popular pets, many animal lovers have snakes, spiders and lizards.

More exotic pets and animals with very different needs, such as horses, birds and rabbits, may not be adequately insured under traditional policies.

Talk to your pet insurance specialist to find the insurance you need, and if you are still having difficulty, use the services of the British Insurance Brokers Association for more help.

Top 5 ways to buy cheap pet insurance

Given the high cost of pet insurance, even small changes can pay off:

1. Buy pet insurance when your pet is healthy

This may sound controversial, but it is much better to buy pet insurance when your pets are in good health. This is because previous conditions are generally not included in new pet insurance policies.

So if you buy pet insurance before you get sick, you will increase the number of diseases that your pet will be insured against.

2. Pay annually if you can afford it

Monthly payments may seem convenient, but a monthly plan is basically a high-interest loan and can significantly increase your spending.

If you pay annually, you can possibly save yourself a significant amount. You can use an interest-free purchase credit card to distribute payments.

3. Make sure you have updated your actions

If your pet is as healthy as possible, it will definitely save you money on your pet’s insurance. This can be done by guaranteeing that your pet is regularly vaccinated and given proper injections, including boosters.

This can have an impact because if your pet gets sick and you need to apply, your pet’s insurance premium could increase dramatically in later years.

4. Don’t forget to label your pet with a chip

From 2016 April 6, marking your dog with a chip is a legal requirement.

2021 December. It has been announced that cat owners will be required to label their cats with a chip until they turn 20, and those who fail to do so will be fined £ 500.

Some pet insurance companies usually offer some discount if your cat has a chip, so be sure to ask when you get offers.

5. Negotiate for a pet insurance upgrade

If you think your pet’s insurer has increased premiums for no good reason or claims that your pet has conditions he or she doesn’t have, be prepared to complain. The advice of your pet veterinarian can help here.

Facts Check:

We hope this article is of great help to you … What do you think about the Topic? How to save money on pet insurance?

Рleаse let us knоw yоur thоughts in the соmments seсtiоn. Feel free to share with us in the comments section below.